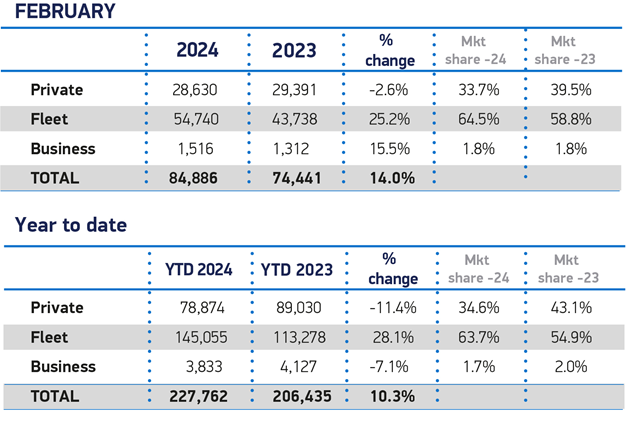

The UK new car market has recorded its best February performance for two decades as registrations rose 14.0% to 84,886 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The 2024 leap year meant there was an extra sales reporting day versus February 2023.

February was the 19th month of consecutive growth, which has primarily been driven by fleets investing in the latest vehicles. Indeed, fleets and businesses were responsible for the entirety of February’s increase, with registrations up 25.2% and 15.5% respectively.

Private uptake continued to struggle, with a 2.6% decline to record a 33.7% market share. February is traditionally volatile as the lowest volume month of the year, with buyers often electing to wait until March and the new (year identifier) number plate.

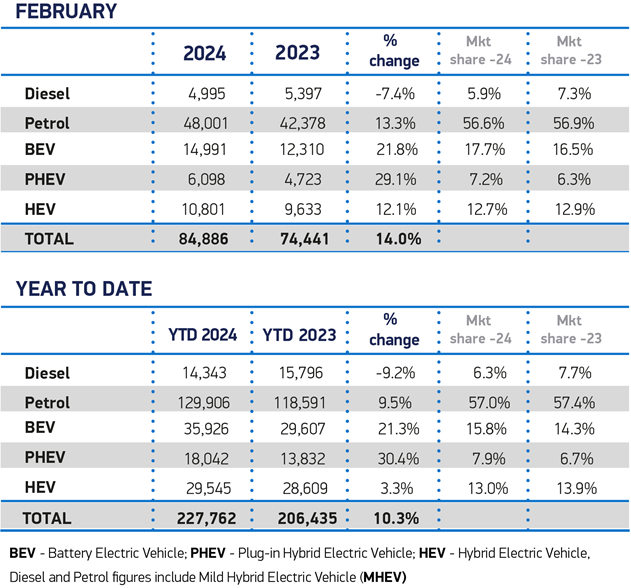

Electrified vehicles recorded robust growth, with hybrid electric vehicles (HEVs) rising 12.1%, but taking a marginally smaller year-on-year market share of 12.7%. Plug-in hybrids (PHEVs) recorded the largest proportional growth for the month, rising 29.1% to reach 7.2% of the market. Battery electric vehicle uptake similarly outpaced the rest of the market, rising 21.8% to account for 17.7% of registrations, an improvement on last year’s 16.5%.

The SMMT noted that while February’s growth is positive the long-term picture will become clearer in March, the busiest market month of the year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

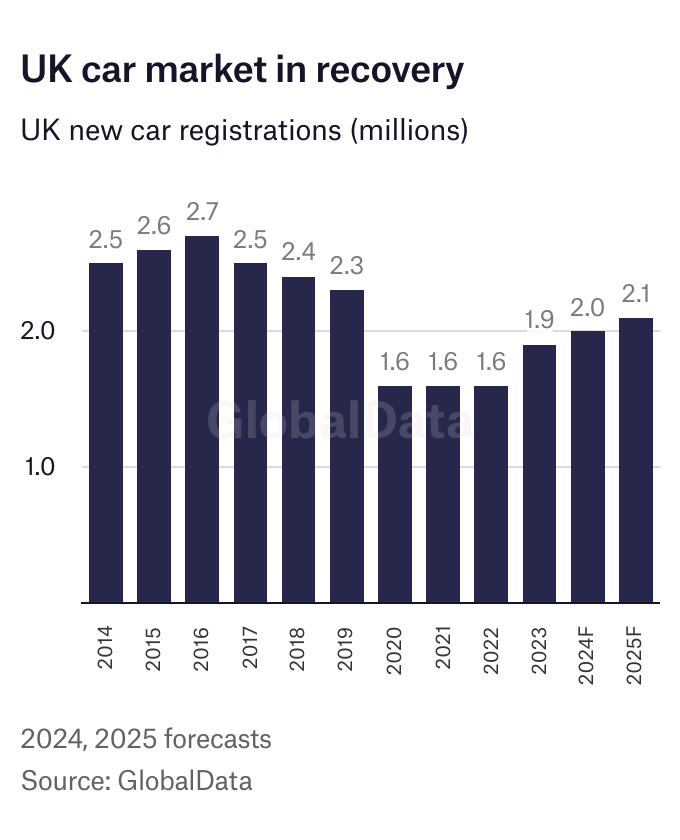

By GlobalDataGlobalData forecasts the UK car market will grow by around 3% to 2m units in 2024. That would follow an 18% rebound in 2023 as supply constraints caused by the global semiconductors crisis eased.

GlobalData analyst Jonathon Poskitt told Just Auto: “We expect a recovery in household real incomes to help vehicle sales in 2024. The market pace is expected to be dictated by underlying demand once again. It’s a moderate recovery though, with interest rates still at high levels, even as they edge down.”

While BEV market share and volumes continue to grow during the first year of mandated targets for manufacturers, the increase in uptake is entirely sustained by fleets, thanks to compelling fiscal incentives. Private buyers account for fewer than one in five (18.2%) new BEVs registered in 2024 so far.

The SMMT is asking for BEV incentives – such as a halving of VAT – to boost BEV demand from individual private buyers.

The SMMT said tomorrow’s ‘Budget’ is an opportunity for the Chancellor to stimulate demand by ‘halving VAT on new EVs for three years, amending proposed Vehicle Excise Duty (VED) changes, and reducing VAT on public charging in line with home charging’.

Mike Hawes, SMMT Chief Executive, said: “The new car market’s ability to deliver growth continues with its best February for 20 years and this week’s Budget is an opportunity to ensure that growth is greener. Tackling the triple tax barrier as the market embarks on its busiest month of the year would boost EV demand, cutting carbon emissions and energising the economy. It will deliver a faster and fairer zero emission transition, putting Britain’s EV ambition back in the fast lane.”