Local sales by South Korea’s five main automakers combined plunged 18% to 99,503 units in February 2024 from 121,039 a year earlier, according to preliminary wholesale data released individually by the manufacturers.

The data excluded some low-volume commercial vehicle manufacturers while import brands will be covered later.

The sharp sales decline was due mainly to production stoppages at Hyundai, for plant refurbishment and line maintenance, while the Lunar New Year holidays also reduced working days in February.

Hyundai and Kia said the delayed announcement of this year’s government subsidies for battery electric vehicle (BEV) sales also had an impact on purchases last month.

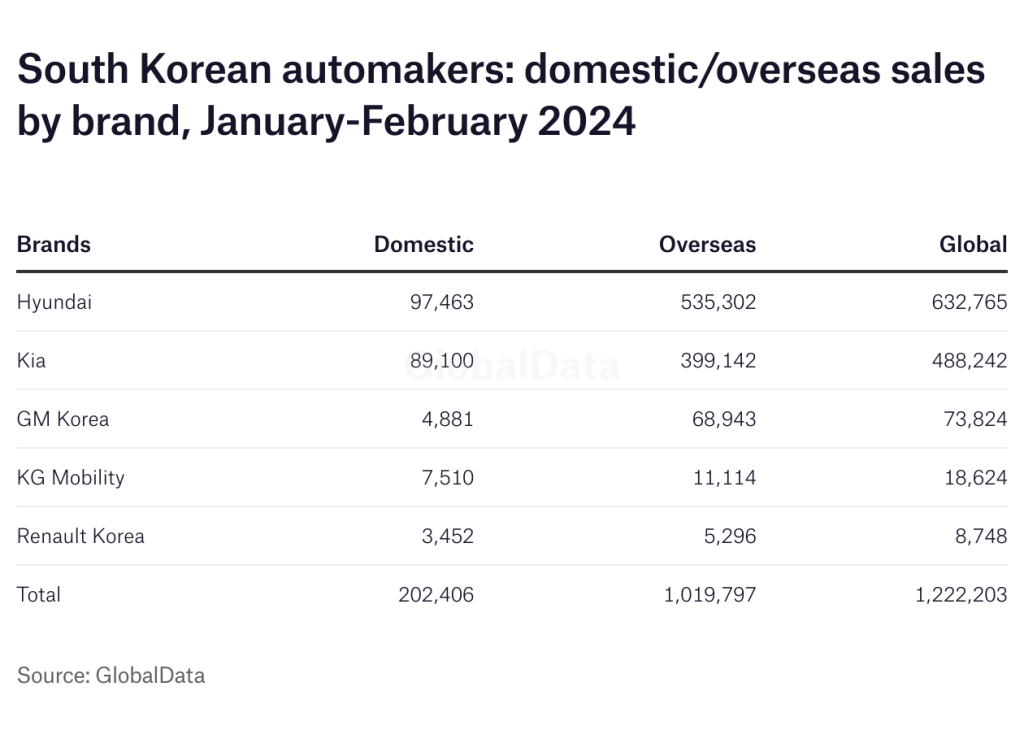

In the first two months of 2024, sales by domestic manufacturers were down 11% to 202,406 vehicles from 226,290 a year earlier with Hyundai volume falling 16% to 97,463 units while Kia sales were just slightly lower at 89,100. GM Korea volume doubled to 4,881 units, as demand continued to rebound following the introduction of new locally made models last year, while KG Mobility sales plunged 45% to 3,748 units and Renault Korea sales were down 19% to 1,807 units.

Global sales by the big five automakers, including vehicles produced overseas by Hyundai and Kia, increased 1% to 1,222,203 units in the first two months of 2024 from 1,208,952 units a year earlier while overseas sales increased 5% to 1,019,797 from 974,390 units.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHyundai Motor volume fell 4% to 314,909 units in February from 328,308 a year earlier, reflecting those lower domestic sales which more than offset a slight increase in overseas sales. Overall sales in the first two months of the year were down 1% at 632,765 from 638,431 previously.

Domestic sales plunged 27% to 47,653 units last month from 60,515 after the company suspended production at its Asan plant to switch to EV output while line maintenance work was also carried out at its Ulsan No 3 plant. Cumulative two month domestic sales were down by over 16% at 97,463 from 116,518 units. The company introduced a facelifted Ioniq 5 BEV this month with a longer range battery.

Overseas sales increased 1.5% to 267,256 units in February from 263,293 and by 3% to 535,302 units year to date (YTD) from 521,913, driven by strong demand in North America, Europe and India.

Hyundai stuck to its target of 4.24m sales worldwide in 2024, including its Genesis luxury brand, a slight increase on last year’s volume. The company lowered its domestic sales forecast to 704,000 units while increasing overseas sales expectations to 3.54m, helped by the expected completion of its Metaplant Georgia facility in North America in the fourth quarter.

The automaker said it aimed to optimise its model line and vehicle supply management for each region to maximise profitability. It also said it plans to strengthen BEV production, establish flexible business strategy to adapt to market changes and “reinforce pre-emptive risk management capability”.

Kia sales worldwide fell 5% to 242,656 units in February from 254,405 a year earlier, reflecting mainly the sharp drop in domestic sales and also slightly weaker overseas volume. Global sales in the first two months of the year, including special vehicles (SPVs) such as military transport, were slightly higher at 488,242 units from 489,510 previously.

Domestic sales, including a small number of SPV exports, fell 12% to 44,308 units last month from 50,404 reflecting the fewer working days and delayed EV subsidies. In the first two months of the year, domestic sales were slightly lower at 89,100 units from 89,385, with the Sorento and Sportage SUVs and the Carnival MPV its best selling models.

Overseas sales fell by 3% to 198,348 units in February from 204,001 units while cumulative volume was just slightly lower at 399,142 units from 400,125 units. Its two most popular models overseas in this period were the Sorento and Seltos SUVs.

Kia aimed to sell 3.2m vehicles in 2024, including 530,000 locally, 2.663m overseas plus a further 7,000 SPVs. The automaker would continue to expand its BEV range with the launch of the new EV5 compact SUV following the launch of the EV9 SUV in the second half of last year.

Kia will also complete redevelopment of its Gwangmyeong BEV plant this year which will produce the compact EV3 and EV4. The medium term plan is to sell 4.3m vehicles annually by 2030 of which 1.6m are expected to be BEVs.

GM Korea sales increased by 17% to 30,630 vehicles in February from 26,191 units a year earlier, as the automaker continued to enjoy a strong rebound following the introduction of the new Trax crossover vehicle at its Changwon plant early last year. Sales were up by 74% at 73,824 units in the first two months of the year from 42,442 units with the Trailblazer SUV and Trax crossover vehicle by far the company’s best-selling models with most output shipped overseas.

Local sales jumped 78% to 1,987 units last month from 1,117 units while cumulative two month sales increased 128% to 4,881 units from 2,138 units driven by the launch last year of the new Trax and the facelifted Trailblazer.

Exports increased 14% to 28,643 units in February from 25,074 while year to date volume more than doubled to 68,943 units from 31,972 previously.

KG Mobility global sales continued to fall in February, by 9% to 9,452 units from 10,401 a year earlier, with sharply lower domestic sales more than offsetting higher exports. Cumulative two month sales were down by 13% at 18,624 from 21,374 units. The company, previously known as Ssangyong Motor, was acquired in late 2022 by a consortium led by local steel and chemicals firm KG Group.

Domestic sales plunged 45% to 3,748 units last month from 6,785 as competition from other domestic manufacturers and importers continued to intensify. Year-to-date domestic sales were down by 46% at 7,510 from 13,915 units, despite the launch last September of the new Torres EVX SUV powered by a lithium iron phosphate battery pack. The company said it would strengthen its local sales network to help lift domestic sales.

Exports jumped 56% to 5,704 in February from 3,646 a year earlier and by 48% to 11,114 units YTD from 7,519 units after the company secured a significant number of export orders from Middle Eastern distributors in the last two years, while sales in Hungary, UK, Spain and Turkey also increased.

Renault Korea global sales fell by 4% to 6,877 vehicles in February from 7,150 units a year earlier, with a sharp decline in local sales offset in part by rising exports. Cumulative two month sales were down by 49% at 8,748 from 17,195 units.

Domestic sales fell by almost 19% to 1,807 units last month from 2,218 as the company continued to struggle with rising competition from domestic manufacturers and from imported brands. Cumulative domestic sales were down by over 20% at 3,452 units from 4,334 units. The company plans to add more hybrid models to its range to help revive sales, including a Geely based mid size hybrid SUV in the second half of 2024 under its Aurora 1 programme.

Vehicle exports increased 3% to 5,070 units in February from 4,932 a year earlier, with exports of the XM3 rebounding strongly following Red Sea shipping delays. In the first two months of the year, exports were down by 59% at 5,296 units from 12,861 units.

Renault Korea has agreeed with Geely to produce the Polestar 4 BEV at its Busan plant from the second half of 2025, for sale locally and export. Management has also discussed sourcing local EV batteries from LG Energy Solution, SK On and Samsung SDI.