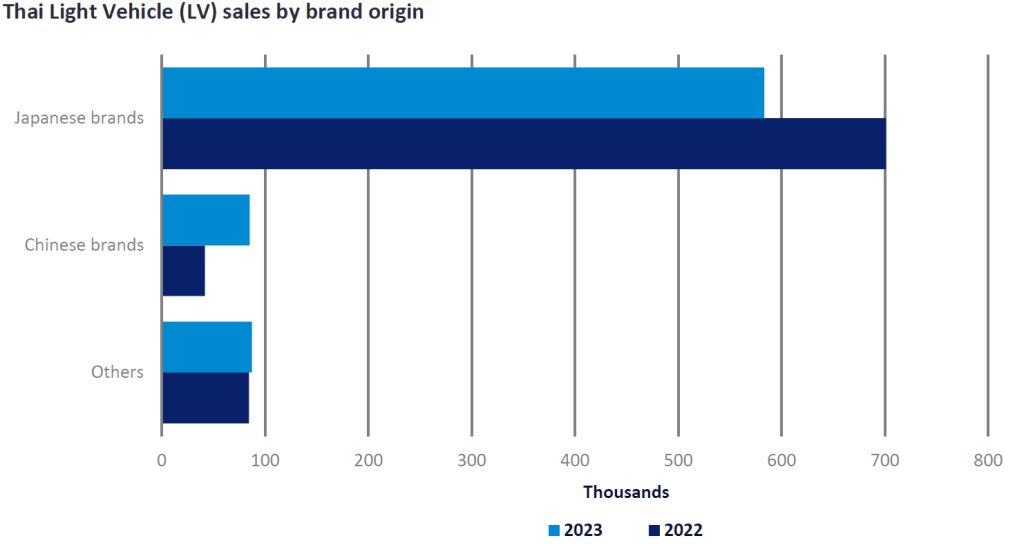

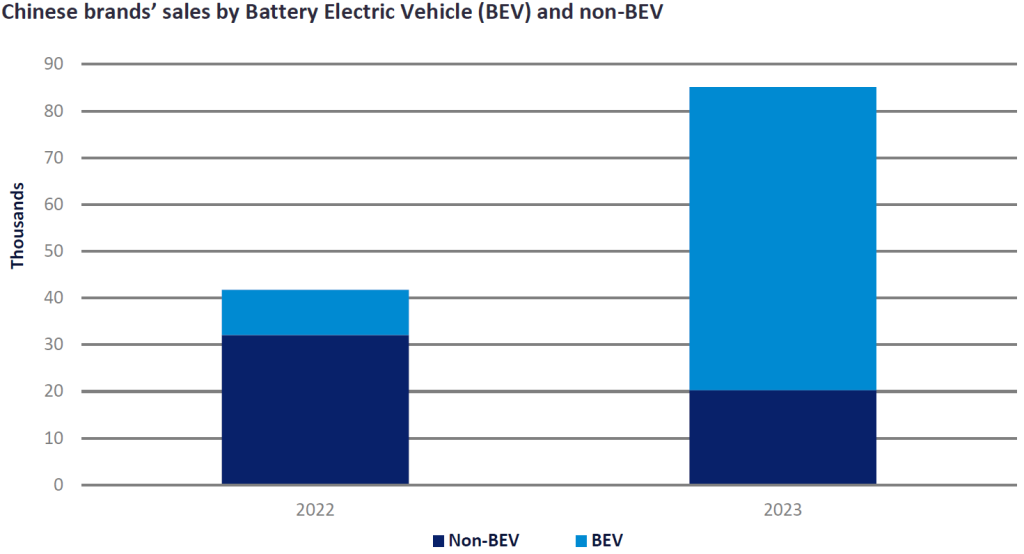

Despite Thailand Light Vehicle (LV) sales falling by 9% YoY in 2023, Chinese automakers’ sales rocketed by 104% YoY (this is not a typo, they really rose by over 100%!) Also, Chinese brands’ market share of the Thai LV market jumped from 5% of the total in 2022 to 11% in 2023.

This outstanding Chinese sales performance was the result of:

- The penetration of new Chinese players BYD and Neta.

- Thailand’s direct cash subsidy under the EV 3.0 policy of up to THB 150,000 towards the purchase of a Battery Electric Vehicle (BEV).

- The introduction of Chinese BEV models while Japanese carmakers still lack this technology and up to the end of 2023 offered very few BEV models on the Thai market, with low sales.

We expect Chinese brands to continue to increase their sales and share of Thailand’s market in the near term because:

- New Chinese players including GAC AION, ChangAn’s Deepal and Chery will arrive in 2024.

- The Thai government announced the second phase of the cash subsidy (EV 3.5) with less benefit than the first EV 3.0 program. The rates are THB 100,000 in 2024 -2025, THB 75,000 in 2026 and THB 50,000 in 2027. The subsidy amount is less important to Chinese players due to their low-cost production methods.

However, the ongoing rise in Chinese brand sales and market share is in doubt in the long term for several reasons.

Firstly, Chinese brand sales so far have been largely driven by BEV models, with volumes inflated by the Thai cash subsidy incentive and by early adopters. If we exclude BEV models from the Chinese automakers’ sales, total Chinese brand sales in 2023 would have dropped by 37% YoY. That’s worse than the overall market performance (-9% YoY) and that of Japanese carmakers (-17% YoY). So, the declining cash subsidy and falling numbers of early adopters could negatively impact Chinese BEV sales in the country.

Secondly, Japanese carmakers are re-inventing their product line-ups by bringing forward their BEV model schedules. Honda will begin to produce and sell its first BEV model in Thailand in 2024. Mazda Thailand will transition from ICE to BEV and is set to launch mainstream BEV models and invest in battery production around 2028-2030. So, the forthcoming Japanese BEV models will pose a threat to Chinese carmakers. But we should not forget that BEV technology is a challenge for Japanese brands and that Chinese brands have a considerable head start.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThirdly, the quality of both the Chinese products themselves and their aftersales service has not been proven so far in the Thai market whereas buyers have full trust in Japanese automakers’ quality standards. Good looks and clever design can create a solid market for Chinese brands, but quality and service will lead to repeat purchases, brand loyalty and customer retention.

And according to Chinese carmaker managers that we have met, Chinese brands that dedicate themselves only to BEVs will encounter obstacles in the medium term since BEV demand will continue to increase but it will not be the leading propulsion type in Thailand. At the same time, the number of players is likely now growing faster than demand.

As such, it is too early to state with confidence that Chinese carmakers will continue to gain share in the Thai car market. One may say “Don’t count your chickens before they’re hatched.”

Ake Lertsirirungsun, Manager, Asia-Pacific, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center

Related Company Profiles

BYD Co Ltd

NetApp Inc

Honda Motor Co Ltd

Mazda Motor Corp